What a 1% Rate Drop Means for Sarasota Luxury Home Buyers

Mortgage rates don’t have to move much to change the math in a meaningful way. And right now, they have.

Freddie Mac’s weekly survey shows the average 30-year fixed mortgage rate at 6.06% (Jan. 15, 2026), compared with 7.04% a year earlier—a drop of about one full percentage point. That headline sounds modest until you translate it into monthly payments, long-term interest, and buying power, especially for buyers who sat out last year because the numbers simply didn’t work.

Why a 1% Rate Drop Matters More Than It Sounds

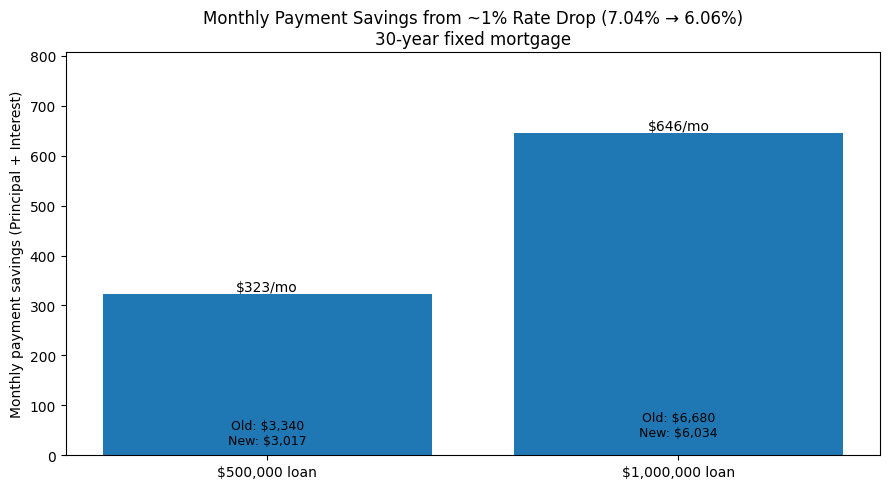

Let’s use two simple examples comparing 7.04% (last year) vs 6.06% (now).

Assuming a 30-year fixed mortgage on a $1,000,000 loan (principal + interest only):

- At 7.04%: ≈ $6,680/month

Total interest over 30 years: ≈ $1,404,768

Total paid: ≈ $2,404,768 - At 6.06%: ≈ $6,034/month

Total interest over 30 years: ≈ $1,172,288

Total paid: ≈ $2,172,288 - Savings from the ~1% drop:

≈ $646/month

$232,479 less interest over the life of the loan

(Excludes taxes, insurance, flood coverage, HOA/condo fees, and any points/PMI—those can materially change the all-in monthly payment.)

Assuming a 30-year fixed mortgage on a $500,000 loan (principal + interest only):

- At 7.04%: ≈ $3,340/month

Total interest over 30 years: ≈ $702,384

Total paid: ≈ $1,202,384 - At 6.06%: ≈ $3,017/month

Total interest over 30 years: ≈ $586,144

Total paid: ≈ $1,086,144 - Savings from the ~1% drop:

≈ $323/month

≈ $116,240 less interest over the life of the loan.

(Excludes taxes, insurance, flood coverage, HOA/condo fees, and any points/PMI—those can materially change the all-in monthly payment.)

And that’s the difference just one year can make.

What This Does to Your Buying Power

A rate drop doesn’t just reduce a payment, it can increase what you qualify for.

If your budget is, “I can afford about the same payment I would have had last year,” a lower rate can translate into more buying power without increasing your monthly principal-and-interest. On a $1,000,000 purchase, holding the ~$6,680/month payment from last year’s rate could support a loan closer to ~$1.11M at today’s rate. That’s roughly $110K+ more in purchasing capacity for the same monthly payment.

For Sarasota buyers, that can be the difference between:

- The neighborhood you want vs. the next-best option

- A better water view

- Newer construction

- Upgrading from “almost perfect” to “this is the one”

Sarasota’s Market Context: Local Stats, Not National Headlines

Real estate is hyper-local, and Sarasota has multiple markets moving at different speeds. The REALTOR® Association of Sarasota and Manatee’s year-end 2025 report shows:

- Sarasota County single-family median sale price: $474,700 (down ~6% year-over-year)

- Sarasota County condo/townhome median sale price: $325,000 (down ~15.3% year-over-year)

- Inventory: single-family around 4.7 months supply

- Inventory: condos/townhomes around 8.1 months supply

- Cash share: ~40.8% of Sarasota single-family sales were cash; condos/townhomes even higher

What does that mean for a financed buyer? Even in a market with a lot of cash, financing still plays a major role, especially for primary residences, relocations, and buyers who prefer to keep liquidity for investing, renovations or lifestyle.

In segments where inventory is higher and days-on-market are longer (notably condos/townhomes), financing terms can become a meaningful lever, both for affordability and negotiating strength.

2026 Angle: If Buying Didn’t Work Last Year, It’s Worth a Second Look

A year ago, many buyers ran the numbers, looked at the payment, and decided to wait. If that was you, the smartest move in 2026 is simple:

Re-run the numbers with today’s rates, today’s inventory, and today’s negotiating landscape. Because the “no” you got in early 2025 may not be the same answer now—especially if:

- You’re buying in a price band where a few hundred dollars a month changes comfort level

- You’re comparing renting vs. owning

- You’re shopping condos where supply is more abundant

- You’re targeting a home that needs updates and you want room in the budget

Practical Next Steps that Actually Help

Here’s how we recommend approaching 2026 if you’re considering Sarasota luxury real estate:

Update your pre-approval (or run a fresh scenario).

Rates, lending guidelines, insurance costs and HOA/condo fees all affect the real payment.

Ask your lender about strategy, not just rate.

Depending on the property and offer structure, you may be able to use points, temporary buydowns or seller concessions to improve the effective payment.

Decide what matters most: price, payment, or lifestyle fit.

Sometimes the right home is the one that checks the lifestyle boxes, even if the rate is not perfect. Other times, optimizing payment is the priority.

Use local intel to shop smarter.

Conditions vary dramatically by neighborhood, building, waterfront vs. non-waterfront, and new construction vs. resale. Sarasota is not “one market.”

Bottom Line

Mortgage rates are about a full percentage point lower than this time last year. That shift can translate into meaningful monthly savings and materially different buying power.

If buying didn’t work for you last year, re-run the numbers and see if 2026 could be your year.

The Laughlin Tanner Group helps buyers navigate Sarasota luxury real estate with clear strategy, local market insight, and thoughtful negotiation, so you can move forward confidently when the math (and the home) align.