Sarasota real estate sales saw double-digit growth, inventory stabilized, and prices continued normalizing as the market rebounded from last October’s hurricane disruption.

The REALTOR® Association of Sarasota and Manatee (RASM) has published its October 2025 market report, offering a clear picture of how the region is performing one year after Hurricane Milton disrupted closings and listing activity in fall 2024. Using data from Florida Realtors®, the report shows a strong year-over-year rebound in both Sarasota and Manatee counties as the market continues to move through its post-storm recovery phase.

With no hurricane interruptions this season, October delivered double-digit gains in closed sales for both single-family homes and condos compared to the unusually weak numbers of October 2024. Inventory is still higher than it was a year ago but is stabilizing on a month-to-month basis, and pricing is gradually normalizing. As conditions rebalance, buyers and sellers are recalibrating expectations around timing, pricing, and negotiation.

October 2025: Key Themes for Sarasota & Manatee

Sales Activity: Closed sales rose strongly across all major property types, helped by the absence of storm-related disruptions this year.

Prices: Single-family home prices were mostly stable or slightly lower year-over-year, while condo prices showed more noticeable softening, especially at the higher end.

Inventory: Active listings increased compared to last year in every segment, with the biggest jump in condos. Month-to-month inventory growth has slowed, hinting that supply may be leveling off.

Time on Market: Properties are taking longer to go under contract—particularly condos—as buyers become more selective and sellers respond with more competitive pricing.

Single-Family Homes

Sarasota County

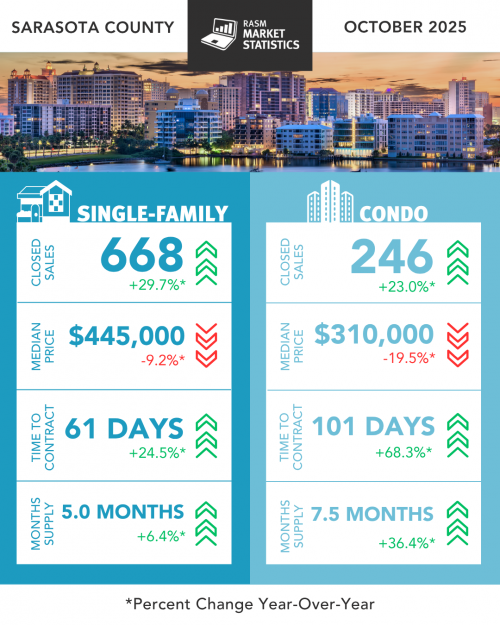

In October 2025, Sarasota County recorded 668 closed single-family sales, a 29.7% increase compared to October 2024. The median sale price declined 9.2% to $445,000, signaling some softening from last year’s levels.

Cash remained a major presence in the market: 40.4% of single-family closings were cash purchases. On pricing, sellers received a median 92.4% of their original list price.

Inventory continued to build but at a more measured pace. Sarasota reported 3,291 active single-family listings, up 11.5% year-over-year, with 5.0 months’ supply of inventory. Homes took a median of 61 days to go under contract and 106 days to close, noticeably longer timelines than a year ago.

Overall, the data points to a single-family market that has moved well beyond last year’s storm-related slowdown and is now operating in a more balanced, less frenetic environment.

Manatee County

Manatee County also posted notable gains. There were 596 closed single-family sales in October, up 26.8% from October 2024. The median sale price held essentially flat at $481,000, a modest 0.2% increase year-over-year.

Cash buyers represented 27.2% of single-family transactions, and sellers received 94.9% of their original list price.

Active inventory in Manatee rose to 2,671 listings, a 12% increase from last year, with 4.2 months’ supply of inventory—slightly lower than Sarasota’s level. Homes went under contract in a median of 55 days and took 105 days to close. While these timelines are longer than a year ago, they have improved somewhat compared to recent peaks, indicating an adjustment phase rather than a slowdown in demand.

RASM 2025 President Debi Reynolds noted that this rebound in closed sales, alongside more predictable pricing and inventory levels, reflects renewed consumer confidence and the resilience of the single-family market in both counties.

Condos and Townhomes

Sarasota County

The condo and townhome segment in Sarasota showed a mix of higher sales and more pronounced price adjustments. In October 2025, Sarasota logged 246 closed condo/townhome sales, a 23.0% increase over October 2024.

The median sale price declined 19.5% to $310,000, driven largely by cooling in the higher-end condo market. Condos remained heavily cash-driven, with 63.4% of transactions closed in cash. Sellers received 89.2% of their original list price, down from 94.4% a year earlier.

Condo inventory expanded to 2,029 active listings, a 23.6% year-over-year increase, and months’ supply rose to 7.5 months—a level that leans toward buyer’s market conditions. Condos took a median of 101 days to go under contract and 141 days to close, both significantly longer timeframes than in October 2024.

Manatee County

Manatee’s condo and townhome market also posted year-over-year sales growth, though more modest than Sarasota’s. The county reported 175 closed condo/townhome sales, an 8.0% increase from last year.

The median sale price was $292,500, down 10.8% year-over-year. Cash buyers accounted for 53.7% of these transactions, and sellers received 92.0% of their original list price.

Active condo inventory in Manatee reached 1,405 listings, up 9.3% from October 2024, with 6.3 months of supply. Timeframes extended here as well: condos took a median of 86 days to go under contract and 128 days to close, marking a considerable increase from a year earlier.

According to Reynolds, condo sellers are navigating a more competitive landscape with heightened price sensitivity. Strategic pricing and accurate positioning—backed by current market data—are now critical to achieving successful outcomes.

Putting the Numbers in Context

While the year-over-year statistics show sizable gains in sales, it’s important to remember that October 2024 was heavily affected by hurricane-related disruptions. The unusually low baseline from that period makes today’s annual increases appear more dramatic than they might in a typical year.

Looking at more recent month-to-month patterns, Sarasota and Manatee counties appear to be moving toward a healthier balance. Sales activity has improved, prices are finding a new equilibrium, and inventory growth is slowing as the market works through the excess supply built up over the past year.

Data Source: This October 2025 market summary is based on statistics from Florida Realtors® using data compiled from Stellar MLS. For detailed historical data dating back to 2015, visit MyRASM.com/statistics.